In this new financial year we have seen state based pension schemes increase. In the UK, those with the Full UK State Pension have been given a £4.40 per week increase – over £200 per annum. This is due to the ‘Triple Lock’ which ensure the UK State Pension must rise by at least 2.5% per annum, even if wages and inflation are less than that.

Is this sustainable and/or fair?

That is a question for Politicians to debate, however, it certainly seems unsustainable when we consider how long people are now living, how much of a % of the population is working vs retired and the general cost to Governments globally of recovering from Covid (an amount that I am sure it is not yet possible to calculate completely).

So what can you do to ensure that you do not sleepwalk into poverty?

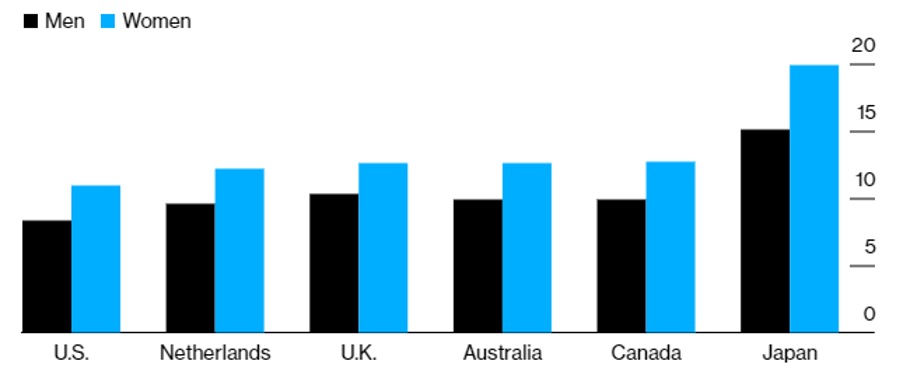

The below article shows the average number of years that people will live AFTER the point that they run out of money. At this point, they would be completely reliant upon state support. As the average age of death continues to increase and the number of centurions is predicted to rise markedly this is, in my view, one of the biggest threats to the developed world as we know it. As at now, the average female in Japan will die 20 years AFTER running out of money which surely indicates that this person is not living their best life during this period.

Responsibility has shifted over the last 2 decades or so. Final salary pension schemes are a thing of the past and the responsibility is now on YOU to save, understand, manage and calculate.

So what can you do to ensure you do not become a statistic:

- Learn. To my knowledge, financial literacy has not made it into the school curriculum in many parts of the world and I meet a number of people on a daily basis who have little to zero knowledge. A bit of knowledge regarding markets, inflation, the relationship between asset classes and interest rates etc would surely be beneficial.

- Understand. Understand the value and structure of the assets you already have. This may seem obvious yet I meet people on a daily basis who do not have full working knowledge of what they already own. The most common example of this is pension schemes – talk to me or somebody like me and get help with it if needed. There is unlikely to be a disadvantage to doing so.

- Plan. Speak to an advisor and ask them to help map out your financial future. Work out what you want, when you want it and how you want it to be structured and then let them advise you on the best way of getting there. If, for some reason, you doubt the validity of their advice (which seems to be common in the era of Dr Google) then check with another one.

Remember – nobody has ever complained because they saved too much money for their future and doing something is always going to be better than doing nothing at all.

World’s Retirees Risk Running Out of Money a Decade Before Death, By Ben Steverman

One of the toughest problems retirees face is making sure their money lasts as long as they do.

From the U.S. to Europe, Australia and Japan, retirement account balances aren’t increasing fast enough to cover rising life expectancy, the World Economic Forum warns in a report published Thursday. The result could be workers outliving their savings by as much as a decade or more.

“The size of the gap is such that it requires action” from policymakers, employers and individuals, said report co-author Han Yik, head of institutional investors at the World Economic Forum. Unless more is done, older people will either need to get by on less or postpone retirement, he said. “You either spend less or you make more.”

In the U.S., the forum calculates that 65-year-olds have enough savings to cover just 9.7 years of retirement income. That leaves the average American man with a gap of 8.3 years. Women, who live longer, face a 10.9-year gap.

The forum assumed retirees would need enough income to cover 70% of their pre-retirement pay, and didn’t include Social Security or other government welfare payments in the total.

The retirement savings gap is about 10 years for men in the U.K., Australia, Canada, and the Netherlands, the forum says. Longer-living women in those countries face an extra two to three years of financial uncertainty.

Retirement Savings Gap

Estimated years of life expectancy past retirement savings, by country.

Estimated years of life expectancy past retirement savings, by country. Source: World Economic Forum

Most of the world’s retirees are doing well compared with those in Japan, where the retirement savings gap is 15 years for men and almost 20 years for women.

While Japanese workers save no less than others, they tend to invest in very safe assets that produce few gains over time, Yik said. As a result, average savings in Japan are only enough to cover 4.5 years of retirement.

Meanwhile, life expectancy at birth for Japanese women is 87.1 years — the highest in the world, according to the Organization for Economic Cooperation and Development — and 81 years for men.

Across the world, governments and employers have pushed more responsibility for retirement onto individuals, by shifting from traditional pensions to defined contribution plans, mostly known as 401(k) plans in the U.S.

“All the risks that governments and employers used to have, we’ve shifted that onto workers,” Yik said.

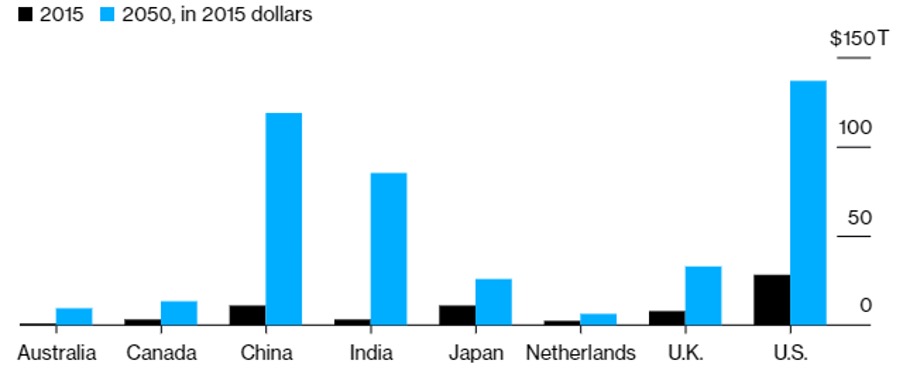

The size of the world’s collective retirement savings gap could exceed $400 trillion by 2050, up from $70 trillion in 2015, according to the report. The U.S.’s savings gap will be the largest at $137 trillion, followed by China at $119 trillion and India at $85 trillion.

Widening Global Shortfall

Total retirement savings gap by country.

Total retirement savings gap by country. Source: Mercer analysis for the World Economic Forum

Among the forum’s recommendations are making sure more workers are covered by retirement plans on the job. Employers should be doing more to improve investment options while pushing workers to save a sufficient amount of their income, according to the report.

Fewer than half of the 1,900 retirement plans served by Vanguard Group automatically enroll workers, according to the firm’s “How America Saves 2019” report released Tuesday. That number has risen quickly, however, doubling to 48% last year from 24% in 2009.