In This Article I Show You How You Can Make £500K Through Comfortable Saving Techniques That Anyone Can Do

2020 was a difficult year for many of us. But the article below from the BBC shows that, in the UK at least, lots of people were actually able to SAVE MORE. Of course, there were others who were more badly impacted. But the article quotes MoneySupermarket who suggest that TWO THIRDS of Brits saved £586 per month.

So how can that best be utilised?

1. Budget

This is the key to all financial planning. If you were planning anything whatsoever, whether you are a management consultant, a builder or in the Military as I once was you would know what your resources are, what troops you can put to task, what assets you have at your disposal. Planning your finances is the same and in order to discover that information you need a budget.

Don’t forget to include the ‘annual spends’. Holidays, Christmas presents, school fees (if applicable) are all things that we spend on less frequently. However, they need to be included in your budget.

2. Understand your goals

Speak to an advisor and work out what you want and when you want it and what you want it to look like. This will give you structure and something to work towards.

3. Choose the right vehicle

Depending upon your location, there will be lots of different options available to you. Speak to an advisor and find the best one for your circumstances.

4. Don’t over commit

Saving is a process and discipline is key. If you commit too much then you will simply stop doing it and that is the very worst possible outcome. Half what you think is achievable and then probably use less than that. Through that methodology there should never be a reason to stop as cash should continue to build.

5. Pay yourself first

Your goals are a bill that need funding. Treat them like every other financial obligation that you pay such as mortgages, car repayments, pensions etc.

6. Take advice

Of course I am biased, but advisors will guide you throughout the process. It is long, there will be bumps in the road and it may not always go as you planned, however, the advisor should be that sound board for you to check everything with whenever you need and ensure that everything is on track for you.

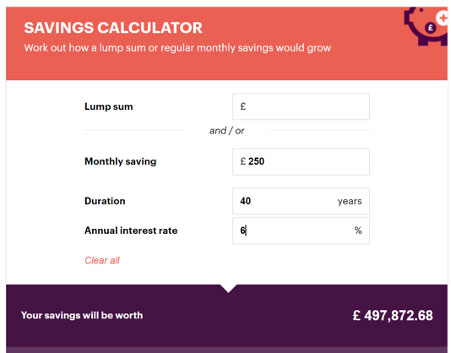

Below we can see a chart from ‘This Is Money’ showing the maths of what saving £250 per month for 40 years could look like if it grew at 6% per annum. Let’s accept some points – we’re all likely to work for 40 years so that part of the maths is workable, 6% average growth per annum is fair historically and £250 is less than half what Moneysupermarket say two thirds of Brits have spare each month.

So don’t wait for tomorrow, get your financial journey started today and begin working towards a better future.

Spent Less, Saved More: What We Bought This Year

People spent less and saved more in 2020 as the pandemic led to shops, pubs and attractions being closed down.

Consumer spending was down 7.1%, says Barclaycard, which tracks almost half of all credit and debit card spending.

However spending on essential items climbed 4.1%, while independent businesses benefited as many more of us shopped locally.

Meanwhile Brits working from home saved an average £110 a week, according to a separate survey from Aldermore Bank.

“2020 has accelerated many trends,” said Raheel Ahmed, head of consumer products at Barclaycard.

“E-commerce has seen huge growth, working from home has meant many are shopping more locally and experiences within the home, such as virtual work-outs have become the norm.”

Online grocery shopping surged 70.3% over the year and looks set to have become the norm for many.

The amount we spent on fuel fell by more than a fifth – 20.3% – as we made far fewer trips, and prices fell at the petrol pump.

‘Fashion For Independants’

We also spent 15.6% less on clothing, presumably because many worked from home and there were no exciting events to go to that needed new outfits.

The Barclaycard data showed that we spent an extra 28.6% at independent food and drink shops, such as off-licences, butchers and bakeries, compared with a year earlier.

It could be another trend that’s here to stay as the card company’s consumer confidence research showed that 57% of Brits wanted to increase their support of nearby businesses as a result of lockdown restrictions.

Joh Rindom, who runs That Thing, an independent fashion, homeware and accessories shop, said perhaps because people have spent more time at home, perhaps because they’ve focused on what is important to them, this year there has been a “fashion for independents”, she thinks.

Support for florists bloomed during the year with purchases up 22.7% while spending on takeaways online surged 49.1%.

But department stores were hard hit by the change in our spending habits, with spending down 17.2%, while clothing retailers experienced a 15.6% slump, leading to the financial problems at the likes of Debenhams and the Topshop owner, Arcadia.

Saving Up

Brits’ saving habits have been boosted by the change in lifestyle during the lockdown and pandemic changes.

According to Aldermore Bank, weekly savings include £29 from not commuting, £20 on not spending as much on breakfasts and lunches, £22 on not socialising with work colleagues, £18 by avoiding takeaway coffees, and £22 on not going out on weekdays after work.

“The saving habits adopted due to the Covid-19 pandemic are likely to continue beyond this period and turn into better long-term spending routines,” said Ewan Edwards, director of savings at Aldermore.

“One positive to take from 2020 is it has given some people the opportunity to reflect on how to improve their personal finances.”

Research by Moneysupermarket suggested that two-thirds of Brits saved an average of £586 per month in 2020 – equivalent to £7,032 over the course of the year.

Londoners saved the most at £1,286 per month, followed by Yorkshire & the Humber who saved £690 and the East Midlands who saved £619. The Welsh saved the least at £302 per month.

“Some are saving more than ever as a result of no commuting fees, reduced childcare costs and far less going out for meals or day trips,” said Sally Francis-Miles money spokesperson at MoneySuperMarket.

“This is especially evident in London where travel and childcare costs are often far higher.”

‘Hard-hit’

But many have been hit hard and been unable to get into the savings habit in 2020. “Money worries are a very real preoccupation for millions across the country,” pointed out Ms Francis-Miles.

“Thousands have been made redundant or had their hours cut, they may be facing a struggle to cover the basics such as household bills and mortgage or rent payments.”