Posts

There have been lots of articles on line recently saying that the traditional 60/40 portfolio is dead and that investors need to rethink their strategy.

This has been largely due to the sudden rise in treasury yields causing bonds markets to experience volatility.

However, we’re talking about a strategy that has held firm for longer than most investors have been alive, so should we just drop it after a few weeks /months of rising treasury yields?

My view is ‘no’.

Remember the following?:

- Inaction is often the best course of action

- History is not necessarily a guide to the future, but the world has been through economic shocks before

- The 50/50 chart we have looked at previously shows that time is your friend

- Don’t try to time the market

Scorned 60/40 Model Finds Allies in Biggest Test Since 2016

By Emily Barrett

The 60/40 portfolio saw investors through the cataclysm of the pandemic. The global recovery is now proving an even tougher test.

The strategy — an investing stalwart since it arose from Harry Markowitz’s Modern Portfolio Theory about a half-century ago — was already under pressure from the historic decline in bond yields. But the sharp move in the opposite direction is a more immediate threat, as recent market volatility has triggered tandem declines in stocks and bonds.

That jeopardizes the relationship at the heart of 60/40, which relies on the smaller, fixed-income allocation cushioning losses when riskier assets slump. The prospect of a faster economic recovery due to vaccines and heavy government stimulus has hit bonds hard, driving yields up at a speed that’s roiled equity markets. The method now faces one of its most severe tests since 2016, when U.S. President Donald Trump’s election raised expectations that lower taxes and lighter regulation would turbo-charge growth.

Portfolios based around 60/40 performed in 2020, with Bloomberg indexes tracking global and U.S. models providing returns of 14% and 17%, respectively. That hasn’t silenced calls to rethink or abandon the strategy, which mounted after losses in 2018. Cathie Wood recently suggested adding Bitcoin as a hedge against inflation.

Still, the strategy has some prominent defenders.

“If anything, the selloff you’ve seen year-to-date gives you a better entry point for fixed-income in portfolios,” said Erin Browne, multi-asset portfolio manager at Pimco in Newport Beach, Ca. “I don’t think by any means that the negative correlation between stocks and bonds has disappeared, or made bonds less relevant in multi-asset portfolios.”

The performance this year underscores the strategy’s resilience. The euro area, Japanese and Canadian 60/40 strategies tracked were up 3% or more year-to-date as of March 15. The global and U.S. indexes were both up more than 1.5%.

“We’re not talking about what’s the best possible return on your money — that’s another conversation,” said Kathy Jones, fixed-income portfolio strategist at Charles Schwab in New York. She pointed out that a balanced portfolio is defined as capital preservation, income generation and diversification from stocks and other risk assets.

Inflation Link

The correlation that matters is the tendency of bonds to weaken, driving yields higher, as stock markets climb — and vice versa. That positive link between yields and stocks has held since the turn of this century with only minor interruptions, in large part because of benign inflation.

That relationship would only break down if there’s a regime shift in inflation expectations, which major central banks have succeeded in keeping anchored for decades, said Brian Sack, director of global economics for the D.E. Shaw Group. The firm threw its weight behind the hedging power of Treasuries in a paper released last month.

IMG

The paper argued that U.S. government securities acquitted themselves well in the big test of the risk-asset drawdown in March last year. German and Japanese bonds were less effective, because their sub-zero yields created a situation where they were “meaningfully impaired as hedging assets.” A similar fate is looking less likely for Treasuries after recent volatility steepened the U.S. curve, Sack said.

“The rise in yields, if sustained, would provide more room for yields to fall in the future in response to a negative shock,” he said.

The Option To Become A Millionaire

Options trading has been in the headlines more than usual of late. The stock market rally of the last 9 months or so, the GameStop saga and the news that the parents of Alex Kearns will be suing Robinhood following his tragic death have all fuelled this in the past few weeks.

But what are options and should you be buying them?

Here’s the ‘what’ in simple terms:

- Options are a way of making short term gains or losses within the market by having an opinion on the direction that an asset will move. This is what Melvin Capital was doing when it had a short position on GameStop which we looked at last week.

- They can be incredibly volatile and investors can lose or gain a lot of money in a very short space of time.

- Traditionally, they have been used by large asset management firms and hedge funds to actually reduce risk in portfolios by hedging against unexpected market movement. However, more recently they seem to be seen as a ‘get rich quick’ mechanism and are readily available through app based trading platforms.

- Please visit something like Investopedia for a full definition. This link could be useful.

Should you be buying them (‘you’ being the average retail investor)? I am going to say that it is an ‘ok’ (through gritted teeth) but only if you follow certain principles:

- Knowledge – go away and learn a lot prior to doing it. Don’t become a gambler – be an astute investor. There are a myriad of courses either on line or in person that can help you out and teach you the pitfalls.

- Be prepared to lose – this is probably not traditional investing for most people unless you are using the option to hedge against potential losses elsewhere as part of a bigger picture and wider strategy. Therefore, understand what you could lose and be prepared for that.

- Don’t rely on it – unless you get lucky, this is not your retirement plan. I am not saying don’t do it, but don’t bank on it.

- Somebody disagrees with you! – remember that for an option to work, somebody somewhere must think the opposite to what you think or there could be no trade. No that doesn’t necessarily mean that they are right, but it is worth bearing in mind.

The article below goes through some facts and figures of options trading and highlights some of the pitfalls – avoid them!

Retail investors flocking to one of the all-time suckers bets

Financial Times

Drawn by tales of fast money in the land of iron condors, retail traders are swarming the futures market. But do they know what they’re doing?

David Siniapkin, a postal worker in York, Pennsylvania, uses some of his retirement money to trade options. After three years and being down as much as $10,000, he’s broken even.

Siniapkin, 46, said he tries to profit from strategies such as the “iron condor,” which requires placing four different bets on the same security, risking $38 to make as much as $204 on one trade. It takes its name from the payout diagram resembling a bird with outstretched wings. Investors use options to improve returns, hedge risks or speculate on market performance.

Volume in the U.S. has tripled since 2004 to a record 3.61 billion contracts in 2009, while trading by individual investors in the same period has increased fivefold at Fidelity Investments, the world’s largest mutual-fund firm. Sophisticated online software and the growth in training offered by industry groups and brokerages, such as Charles Schwab Corp. and TD Ameritrade Holding Corp., are enabling individuals to execute advanced techniques on home computers that had once been the province of professionals. (Visit the InvestmentNews options strategies section for strategic reports and daily options picks.)

“Trading options is one of the all-time suckers’ bets,” said Whitney Tilson, founder of hedge fund T2 Partners LLC, based in New York. “Most experienced professionals lose money doing it. It’s virtually certain that inexperienced, individual retail investors will lose money doing this.”

About half of options investors earn less than $100,000 and 70 percent trade to increase income and for short-term gains, according to an April survey by the Options Industry Council, an industry education group based in Chicago. Retail traders can access professional-level analytics and trading tools that “weren’t even available to institutional investors five years ago,” said Andy Nybo, head of derivatives research at Tabb Group LLC in New York.

The numbers of trades by individuals rather than institutional investors aren’t available, said Jim Binder, a spokesman for Chicago-based Options Clearing Corp., which settles all trading of exchange-listed contracts.

Siniapkin was one of about 100 non-professionals who attended an all-day training class last month provided by online options brokerage Thinkorswim Group Inc., which Omaha, Nebraska- based TD Ameritrade acquired last year for $749 million.

Participants traveled as many as three hours to a windowless Radisson hotel ballroom near Philadelphia and scribbled notes as Bob Groves, a former Standard & Poor’s 100 Index options trader on the floor of the Chicago Board Options Exchange, waved a laser pointer at a projection screen to explain advanced trades.

“I’ll do the iron condors, I’ll do calendars, I like double diagonals,” said Siniapkin, who said he has had “mixed success” with these strategies, known as multi-leg transactions, which involve buying or selling multiple contracts on the same underlying security.

Training lets retail investors understand the risks involved, said Debra Peters, vice president of the Options Institute, the CBOE’s education division, which had a record 41,004 registrations for its free online courses last year.

E*Trade Financial Corp., based in New York, saw a 600 percent increase in attendance at training events last year, and TD Ameritrade’s education arm, Investools, has attracted more than 40,000 clients to its classes since June, about a 50 percent increase from a year earlier, the companies said.

Cost of the courses ranges from free to thousands of dollars. Thinkorswim’s session in April was free and participants were later pitched additional training and online tools, which run from $299 to more than $2,000.

“I’m not a fan of people who say you shouldn’t be doing this,” said Thinkorswim’s founder Tom Sosnoff of investors using complex strategies. “Imagine you walked into the casino and people said to you, ‘You look stupid so you can only play the slots.’”

Options are contracts that grant their buyers the right, without the obligation, to buy or sell a security, a commodity or an index’s cash value at a set price by a specific date. Call options give the right to call a security away from another owner if the security reaches its strike price on or before the contract’s expiration date. Put options give the right to sell.

Like gambling on the Super Bowl and having to beat the point spread, options traders may lose if they predict the correct direction of a stock move and not the magnitude. For example, an investor who buys a put to sell a biotechnology stock before a Food and Drug Administration decision may get the direction of the stock’s move right while losing money if the security doesn’t fall or rise far enough.

“Options trading is always going to be more complicated than equities trading but it doesn’t have to be more risky,” said Randy Frederick, director of trading and derivatives at Schwab, the largest independent brokerage by client assets. “They can potentially reduce the amount of losses in a bearish market.”

Simpler strategies include buying put spreads to protect stocks from declines and selling call options to profit from the sale while betting that the stock won’t rise past a given level.

“My first couple of trades I did very, very well and I got a little big headed and very, very greedy, and I ended up blowing out an account,” said John Mahoney, 49, an engineer who trades options weekly. “I lost about $20,000 initially.”

Mahoney said he made $4,000 one week in April by playing multiple contracts and is working his way back into the market by trading smaller amounts and attending classes.

Regulators permit trading options using retirement accounts, said Herb Perone, spokesman for the Financial Industry Regulatory Authority. Certain trading may violate Internal Revenue Service rules, which is why firms including Schwab, Fidelity, TD Ameritrade, E*Trade, Interactive Brokers Group Inc. and OptionsXpress Holdings Inc. prevent investors from executing strategies that may cause an IRA to go into debt, according to the companies.

About 46 million U.S. households owned IRAs last year, according to the Investment Company Institute, a Washington- based mutual fund trade group. Accounts held for 20 years or more had a median of $75,000 in assets, according to ICI.

Michael Madden, a 48-year-old sales manager from Whitehall, Pennsylvania, said he transferred some of his IRA money to Thinkorswim to trade options. He said he lost about 40 percent when he started three years ago and has since recovered those losses, purchasing about $5,000 to $10,000 in contracts a week.

Fidelity has started allowing spread trades in IRAs, an options strategy requiring two transactions usually executed at the same time, said Gregg Murphy, who oversees equities and options trading for the Boston-based company’s retail customers. Schwab, based in San Francisco, is testing spread trading for retirement accounts with a few hundred customers and hopes to expand it later this year, said Frederick.

Options shouldn’t be an integral part of investors’ long- term planning, of which retirement money is the “nucleus,” said Jonathan Krasney, president of Krasney Financial LLC, a Mendham, New Jersey, fee-based wealth management firm.

“My concern is that investors can quickly dig themselves into a deep hole if they venture into the options market,” Krasney said. Most trading involves contracts that expire within months, so investors can’t hold them indefinitely to recoup losses or wait for gains, as they can with stocks, Krasney said.

Brokers must approve investors to trade options, said Gary Goldsholle, vice president in Finra’s general counsel office. Customers must provide companies with details about their financial status and trading experience, and sign a document saying they received a copy of the Characteristics and Risks of Standardized Options from the Options Clearing Corp.

Karen Fitchett, 64, said the learning curve has been steep. The New York real estate investor said she has lost tens of thousands of dollars trading options since starting in 2007, which is why she still attends classes like the one provided by Thinkorswim.

“It’s become like an intellectual affair,” she said. “I just became seduced.”

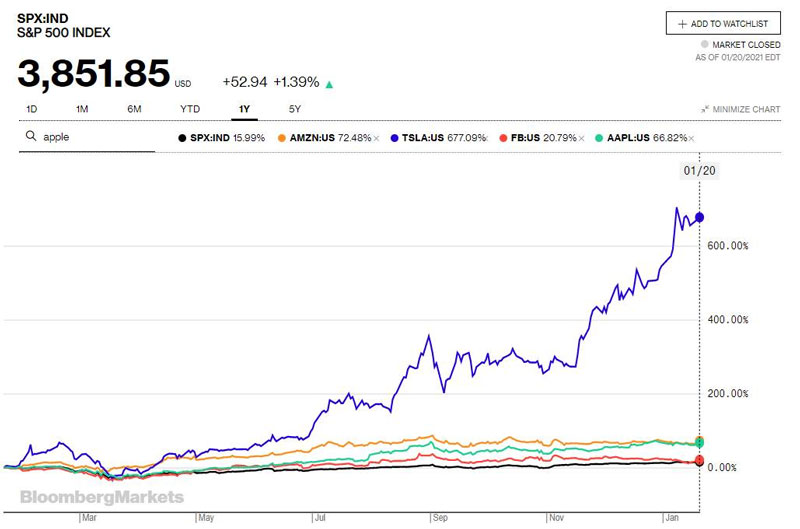

In the article below we can see that the people who made the most money in 2020 come as no great surprise really, with Elon Musk topping the list after the share price of Tesla went on an incredible rally. I must highlight that this was written on 21 Dec so perhaps things may have changed in the last week!

But how did they do it?

Stock market gains

Tech stocks in particular soared during 2020 with companies like Tesla, Amazon, Facebook etc seeing huge gains.

Those companies, however, can also be owned by you – if you had bought Tesla shares you have seen the same gain as Musk (although you probably didn’t start 2020 with $35b!).

Or, you could own the market where these stocks are listed – the S&P 500 returned over 18% in the calendar year which is still a great calendar year for returns (even though it was ‘bumpy’). Clearly, however, a large portion of this gain can be attributed to the large tech stocks in the index for this particular year.

They didn’t sell

The biggest returns last year would have been made by those who stayed invested. Panicking when markets are falling is a natural reaction, however, if you own a well diversified portfolio capable of riding the storm then fear not. That said, if you own one stock like those that made the most money this can be a concern depending upon the underlying fundamentals of the company.

Day Trading

I hear this a lot within my job – normal every day people wanting to ‘day trade’. For 99.9% it will be a very easy way for you to lose money quickly and is not something that any of the those who became significantly wealthier were up to. By good things – ETFs and Mutual Funds combined – and leave it alone!

Work Super Hard

This goes without saying. Elon Musk apparently runs his daily diary in 5 minute blocks and averages 100 hours per week. That is incredible (albeit he is not the ‘normal’!). I am unsure as to whether this has been maintained since fatherhood but he certainly seems to be doing the right things at the moment.

Time

The classic cliché is ‘time in the market is better than trying to time the market’ and most of the people on then list below have played a ‘long game’ to a certain degree. Jeff Bezos didn’t dream up Amazon yesterday, it has taken years of work, flexibility, adaptability and effort. Zhong Shashan founded his water business in 1996 and, until last year, many of us would have never heard of him – he took his time, worked hard, didn’t sell and has now made the gains.

S&P 500 index

Top 5 billionaires who added the most to their net worths in 2020

Tom Huddleston Jr. – 21st December 2020

The year 2020 was a difficult one financially for many people around the world, with the global coronavirus pandemic wreaking havoc on countless businesses and roughly 19 million Americans currently collecting unemployment benefits.

But for some of the weatlhy, it’s a very different story. During 2020, Amazon’s sales have spiked, as social distancing restrictions forced people to do even more of their shopping online, while Tesla’s newfound ability to consistently turn a profit sent the electric automaker’s stock price soaring.

With their companies’ fortunes among those improving in 2020, Amazon founder Jeff Bezos and Tesla CEO Elon Musk have seen their own personal net worths skyrocket this year, as well. (Much to the chagrin of critics like Democratic Senator Bernie Sanders, who has ramped up his calls for higher taxes on corporations and the wealthy.)

In fact, Tesla’s banner year catapulted Musk all the way to second (behind Bezos) in the rankings of the world’s wealthiest people, according to Bloomberg, after he started the year ranked 35th on the list.

Here’s a look at the five billionaires who have seen their fortunes increase the most this year, according to Bloomberg’s Billionaires Index, led by Musk’s meteoric rise:

These 5 billionaires added the most to their net worths in 2020

Elon Musk, founder of SpaceX and chief executive officer of Tesla Inc

Elon Musk – Founder of SpaceX and Chief Executive Officer of Tesla Inc

Musk has added a whopping $140 billion to his net worth in 2020, bringing the total to $167 billion, as of Monday, according to Bloomberg. That was good enough to boost Musk a few dozen spots up the billionaires rankings, as he surged past Bill Gates to claim the second spot in November.

At the beginning of 2020, Musk’s net worth was nearly $30 billion (still a very healthy number). But, Tesla’s exceptional year sent that number climbing, as the electric automaker’s stock has exploded by over 650% since the start of the year, thanks to Tesla setting new sales records and reporting its fifth consecutive profitable quarter.

Musk owns a roughly 20% stake in Tesla, so the company’s surge provided the main boost for his personal gains, as that stake is now worth more than $125 billion. The tech billionaire also owns a stake in his aerospace company, SpaceX (which also had a big year, launching astronauts into space for the first time), that Wealth-X values at more than $15 billion.

Jeff Bezos, Amazon CEO

Jeff Bezos, Amazon CEO

Bezos started 2020 as the world’s wealthiest person and all he’s done is add more than $72 billion to his net worth, as Amazon’s revenue continued to grow this year amid the pandemic-led boost in online shopping. Bezos, who owns over 50 million shares of Amazon stock worth more than $170 billion, saw his overall net worth climb to $187 billion this year. (Bezos is the richest man in modern history, and his net worth even crossed the $200 billion mark at one point this past summer.)

Zhong Shanshan, the chairman of Nongfu Spring Company

Zhong Shanshan, founder of Nongfu Spring

Zhong Shanshan’s net worth has soared by $62.6 billion in 2020 (it’s currently at more than $69 billion), according to Bloomberg. Zhong became China’s richest man in September, after his bottled water company, Nongfu Spring, launched a wildly successful IPO that raised more than $1.1 billion and left the company he founded in 1996 valued at nearly $70 billion overall. The 66-year-old Zhong owns over 84% of the company — a stake now valued at roughly $60 billion, which helped him pass other billionaires such as Tencent’s Pony Ma and Alibaba founder Jack Ma to become China’s wealthiest person in recent months.

Zhong also owns a controlling stake in Chinese pharmaceutical company Wantai Biological, which saw its stock increase by nearly 2,000% at one point in 2020 as the company works on developing a nasal spray coronavirus vaccine.

Colin Huang, chief executive officer and founder of Pinduoduo

Colin Huang, founder of Pinduoduo

Forty-year-old Colin Huang added $33 billion to his net worth in 2020, bringing it to nearly $53 billion, according to Bloomberg. And, that was in a year when he stepped down as CEO of the company he founded five years ago, fast-growing Chinese online marketplace Pinduoduo.

Founded in 2015, Pinduoduo is an online marketplace that allows groups of people to share the cost of a purchase. Seeing faster revenue growth than rival Chinese e-commerce businesses like JD.com and Alibaba, Pinduoduo went public in 2018, making Huang a billionaire. Like Amazon and other e-commerce giants, Pinduoduo has benefitted from increased online shopping in 2020 due to the global pandemic, which has helped to nearly quadruple the value of Pinduoduo’s stock since the start of the year.

Huang stepped down as CEO of the company in June, citing a desire to “hand over more managerial duties and responsibilities to our younger colleagues” in order to maintain the “entrepreneurial spirit” at the growing company. He remains the company’s chairman and owns a 29.4% stake in Pinduoduo that’s worth well over $50 billion.

Dan Gilbert, CEO, Quicken Loans

Dan Gilbert, Rocket Companies chairman

Gilbert is the 58-year-old owner of the NBA’s Cleveland Cavaliers and the cofounder of Quicken Loans. His net worth increased by $28.1 billion in 2020 (to $35.3 billion overall), according to Bloomberg, with the boost coming after Quicken’s parent company, Rocket Companies, launched an IPO in August. Gilbert owns an estimated 73% stake in Rocket Companies, a stake which is currently worth more than $31 billion.

Others Who Saw Big Gains

Facebook CEO Mark Zuckerberg

Mark Zuckerberg Facebook CEO

Right behind the five biggest billionaire gainers was Facebook cofounder and CEO Mark Zuckerberg, whose net worth has jumped by over $26 billion in 2020 (to $105 billion overall), making him the fifth wealthiest person in the world, according to Bloomberg. Zuckerberg’s wealth is tied to his ownership of more than 375 million shares of Facebook stock, which increased in value by nearly 30% since the start of 2020 despite a recent antitrust lawsuit brought against the company by the federal government.

Jeff Bezos’ ex-wife, MacKenzie Scott

MacKenzie Scott – Bezos’ ex-wife

MacKenzie Scott attends the SEAN PENN J/P HRO GALA: A Gala Dinner to Benefit J/P Haitian Relief Organization and a Coalition of Disaster Relief Organizations at Milk Studios on January 6, 2018 in Los Angeles, California.

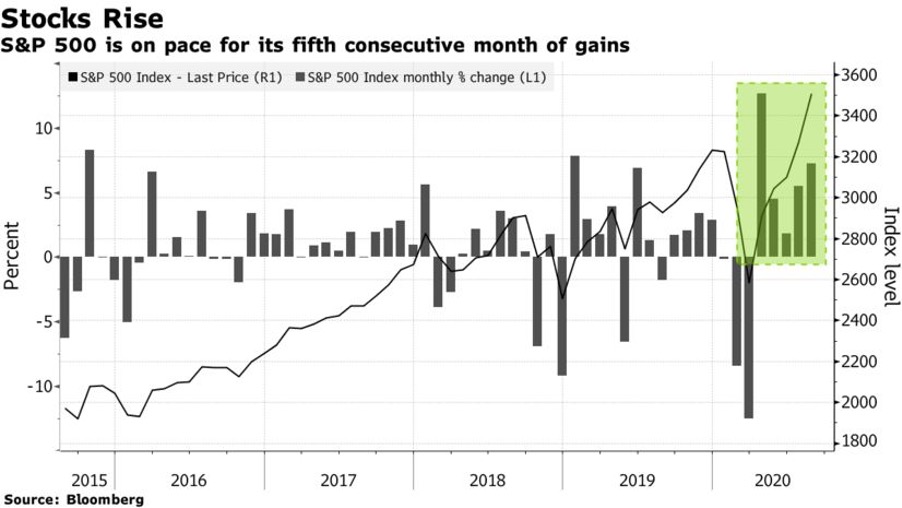

Markets have certainly given us a roller coaster ride in recent weeks with losses in the run up to the US election followed by gains on the outcome followed by euphoria on the back of a potential Covid vaccine.

In this video we look at…

- What’s happened?

- Is it sector specific?

- How does this impact you?

- What should you do about it?

1 – What’s happened?

In outline, markets have rallied. Whether they have rallied too much or not is discussed in the article below but the bottom line is that they have. The UK, Europe and the US are all up significantly since 30thOctober and sentiment has been high.

2 – Is it sector specific?

Yes, very much so. Large tech firms that had benefitted most from Covid restrictions have been the losers whilst those that have suffered a lot during 2020 have been the winners. As the market reacts to the possibility of increased travel, tourism and a return to ‘normal’ we have seen gains for airlines, energy firms and those associated.

3 – How does this impact you?

Well, that depends upon whether you had a well diversified portfolio form the outset. If you did then you would have had a multi geographical exposure as well as exposure to all sectors meaning that you would have captured some of the upside. If you did not and had gone all out on tech based upon the 2020 performance vs other sectors then you would have captured the downside. It has been a great advert for proving the value of diversification.

4 – What should you do about it?

Learn. If you did not enter with a diversified portfolio then see it as an opportunity to consider why you should have done. If you did then pat yourself on the back and keep doing what you are already effectively doing.

Markets explode with euphoria but are they right?

Stock market historians may quibble but I certainly can’t remember a time when blue chip shares soared in the way some of them did today.

The owner of British Airways, International Airlines Group (IAG) rose 40%, airline engine maker Rolls Royce up 33% while cinema owner Cineworld saw its shares rise 50%.

Extraordinary, until perhaps you remember that these companies are the ones whose value has been most destroyed by the coronavirus. IAG for example is still worth more than 40% less than this time last year.

There have been losers today as well. Some of those who have thrived in the time of coronavirus gave back some of their gains.

Home food delivery experts Ocado and Just Eat were both down around 10% and the office workers new best friend Zoom was down 14% as the US stock market opened.Note – it is still worth six times more than it was last year – some habits are likely to stick.

There are also significant challenges in distributing a vaccine which needs to be kept at -80C with stiff competition for the 50 million doses expected to be produced by the end of the year.

Optimism rises

But markets are primarily about sentiment – does tomorrow look better than today – and in that regard there has been a radical and probably permanent sea change.

With more vaccines in development that optimism could grow.

What this result demonstrates is that while the virus is not yet beaten it is beatable.

That ray of light has lit up stock markets around the world.

As always, some people in the markets are already looking for something else to worry about.

If we are returning to a semblance of normality in the months ahead, do the US authorities really need a stimulus package as big as the $3tn to $4tn being discussed by the Biden team?

In fact, does the gargantuan amount of stimulus already announced begin to push up inflation if economies begin to recover quickly.

Those are concerns for another day. For now, the markets, like the rest of us, are enjoying the warm glow of the first significant sentiment boost since the virus started ravaging the world economy.

Those who read/listen to me regularly will appreciate that I see the word ‘proof’ in this headline and laugh on the inside – there is no ‘proof’ but only ‘opinion’ based on what some would call ‘evidence’ and others would call ‘speculation’ – or words to that effect.

That said, isn’t it lovely to see a positive news article regarding equities?!?

So, here is why some people suggest the rally will continue:

1 – The FED. Many will argue that the FED will do what they need to in order to be supportive for US markets and overall economic growth with FED Chair Mr Powell last week announcing that they would be willing to allow inflation to go beyond the traditional 2% target for short periods without putting up interest rates.

2 – Interest Rates. Directly linked to point 1 is interest rates – one of the largest weapons at the disposal of The FED to control inflation/deflation. With record low interest rates and The FED’s insinuation that they’re ok with that for the time being it becomes difficult to make a return from anything other than equities and perhaps property – there is no gain to be had on cash or investment grade debt.

3 – Long Term Growth. Sophisticated investors will always hold equities as part of a diversified portfolio because in real terms they generally offer the best way of achieving long term annualised gains. Ultimately, a record fall followed by a great recovery is not going to alter that belief and, coupled with the first 2 points above it is difficult not to see value in holding equities which is summed up nicely in the below quote:

‘Lerner, who is SunTrust’s chief market strategist, says valuations might stay elevated given the lack of other attractive options to put money to work. He cites the Rule of 72, used to calculate how long it will take for an investment to double given a fixed annual rate of return. (Divide 72 by the assumed rate of return to estimate how many years doubling might take). Using a 5% annualized return, it takes about 14 years for equity investors to double their money. It takes more than 100 years for a 10-year Treasury investment to do the same and 900 years for cash.’

This Market Rally Has Legs, Six Strategists Say. Here’s Proof

By Vildana Hajric and Sarah Ponczek

Fed is not likely to allow a large major decline: Citi

When the stock market started to revive from the depths of the March lows, the killjoys were ready. It can’t last — just look at the state of the economy, they said. It’s going to crash again.

That message was repeated over and over even as the S&P 500 advanced more than 50% and added $10 trillion in value. Since surpassing its pre-Covid high last week, the index has notched records more than a half-dozen times.

The market’s relentless run has prompted many analysts to check what’s under the hood. Some now see evidence to justify further gains, citing everything from the Federal Reserve’s new policy goals to sidelined piles of cash that are ready to be deployed.

“I can’t see what’s going to change people’s perspective on why we should stop buying,” said Randy Frederick, vice president of trading and derivatives at Charles Schwab & Co. “If we continue to buy and we have a few more pullbacks, which I think is likely, people will just continue to jump in and buy those dips.”

In the wake of the S&P 500’s surge, a number of strategists have raised their forecast for where the index will end the year. Those at Goldman Sachs Group and RBC Capital Markets did so earlier this summer. On Friday, Brian Belski, chief investment strategist at BMO Capital Markets, reinstated his year-end S&P 500 target of 3,650. That represents a roughly 4% advance from current levels.

Pointing to the resourcefulness of American companies and society’s ability to pivot, Belski wrote in a note that;

“U.S. stocks have exhibited an epic price recovery that not only is unprecedented but tests most major academic and common-sense assumptions.”

Many also cite the Fed’s interventions. Shawn Snyder, head of investment strategy at Citi Personal Wealth Management, says it seems unlikely the central bank would allow a large decline in stocks to happen.

Rule of 72

To Keith Lerner at SunTrust Advisory Services, the move higher over the past few months has created a stretched market, but the buying pressure is reminiscent of what’s typically seen during the first stage of a bull market. Record prices shouldn’t be viewed as a concern, as history shows stocks tend to gain an additional 9.2% over the 12 months following a record high. And he said that an important transition is underway — earnings appear to again be a major contributor to the upward move.

Lerner, who is SunTrust’s chief market strategist, says valuations might stay elevated given the lack of other attractive options to put money to work. He cites the Rule of 72, used to calculate how long it will take for an investment to double given a fixed annual rate of return. (Divide 72 by the assumed rate of return to estimate how many years doubling might take). Using a 5% annualized return, it takes about 14 years for equity investors to double their money. It takes more than 100 years for a 10-year Treasury investment to do the same and 900 years for cash.

“The weight of the evidence in our work still supports a positive longer-term market outlook,” Lerner wrote.

Negative real rates — which take inflation into account — make stocks, as well as certain other hard assets like homes, “particularly attractive” at a time when retail cash in money market funds is hovering near record levels, according to Evercore ISI strategist Dennis DeBusschere. Some of that money could find its way toward equities, he said.

Victoria Fernandez, chief market strategist for Crossmark Global Investments, says she wouldn’t be surprised to see a pullback before the end of the year, but overall, she expects the market to trend higher. In her view, breadth will strengthen, with sectors including consumer staples and financials joining the rally. Any possible positive news on Covid-19 will support stocks, and the Federal Reserve is extremely stimulative.

Equity markets have seen record declines in recent weeks interspersed with the odd close to record daily gain. We have seen the fastest bull to bear turn around in history and it is widely accepted that we are approaching a recession.

So how low can we go? The answer that most people come up with is based on what has happened before. We have seen aggressive pull backs previously in 1929, 1987, 2008 to name a few. In fact, according to the below article:

‘From 1900–2014, there were 32 bear markets. Statistically, they occur about once every 3.5 years and last an average of 367 days.’

That is probably more common than a lot of people think. Indeed, the last 10 years plus has lead us all to feel as though equity markets simply slowly trundle upwards. Most of us have already forgotten about the 19% pullback in Q4 2018 due to it being followed by one of the best years for equity markets in years.

‘For investors who sold at the bottom of these markets, these downtimes had a detrimental effect. Investors who maintained a diversified portfolio and stayed invested so they experienced the subsequent recovery were not harmed. Remaining focused on the long-term is an important thing to do when in the middle of a bear market.’

The below article then goes on to also expand upon bull markets – it is important to remember that these also happen. Right now all everybody can think of is Coronavirus and the upcoming recession, however,

‘Bull markets often follow bear markets. There have been 14 bull markets—defined as an increase of 20% or more in stock prices—since 1930. While bull markets often lasted for multi-year periods, a significant portion of the gains typically accrues during the early months of a rally.’

In a recent article entitled ‘6 tips to navigate volatile markets’ we looked at how missing the best days in the market can severely impact returns over the medium-long term and the simple reality is that there is too much data supporting this stance to deny it.

So what is my job in times like this? How low can we go? Should we have an all seeing eye and be able to predict these things? Goldman Sachs are telling us that we could see the S&P 500 fall to 2,000 and that it will then recover to around 3,000 before the end of the year… are they correct? Does it actually matter whether they are correct if you have a well diversified portfolio that is designed in line with your investment horizon? It would have been great to have sold out 6 weeks ago and now be sitting on a pile of cash. But when would you buy back in? Now? Tomorrow? Next week? You would need to time that right too (ie you would have had to get lucky twice).

The only thing that you can do is remember the basics. Remember the data. Markets are volatile and that is to be expected. It is arguably a little unfortunate to have seen a near bear market in Q4 2018 (it didn’t quite make 20% but wasn’t far off) and then a subsequent one now. Certainly, if you started your investment journey in summer 2018 then it must all be feeling like a waste of time at the moment and a rather uncomfortable ride. For those in that position, I would encourage you to remember the long term and the reason why you invested in the first place which is something that the chart below from Vanguard and the below article perfectly highlight:

U.S. Stock Bear Markets and Their Subsequent Recoveries

By Dana Anspach – Certified Financial Planner.

Bear markets are defined as periods when the stock market declines by 20% or more from the highest point to its subsequent lowest point. From 1900–2014, there were 32 bear markets. Statistically, they occur about once every 3.5 years and last an average of 367 days.

Despite the occurrences of bear markets, markets typically have been up more than they have been down throughout history. From 1950 through 2018, for example, the S&P 500 was up on 53.7% of days and down 46.3% of days, and the number of up days exceeded the number of down days in every decade.

Historical Market Tumbles

In the 1970s, the market dropped 48% over 19 months, and in the 1930s it dropped 86% over 39 months. The most recent U.S. bear market occurred in 2007-2009 when the stock market dropped 57% over 17 months. Another notable bear market is Japan’s “Lost Two Decades” from 1998 to present when market values declined 80%.

For investors who sold at the bottom of these markets, these downtimes had a detrimental effect. Investors who maintained a diversified portfolio and stayed invested so they experienced the subsequent recovery were not harmed. Remaining focused on the long-term is an important thing to do when in the middle of a bear market.

Recovering From a Bear Market

Bull markets often follow bear markets. There have been 14 bull markets—defined as an increase of 20% or more in stock prices—since 1930. While bull markets often lasted for multi-year periods, a significant portion of the gains typically accrues during the early months of a rally.

From 1934–2014, the S&P 500 suffered total return losses of at least 20% in four different calendar years, the most recent being 2008’s 37% decline. In the year after the three previous 20%+ tumbles, the index gained an average of 32%. You have to be willing to stay invested in the market during the downtimes to participate in the recovery.

For example, after the S&P 500 bottomed at 777 on Oct. 9, 2002, following a 2 ½-year bear market, the stock index then gained 15.2% over the following month. Investors who flee to cash during bear markets should keep in mind the potential cost of missing the early stages of a market recovery, which historically have provided the largest percentage of returns per time invested.

In 2008, the S&P 500 bottomed at 683 on March 9, 2009, after declining by nearly 40%. From there it began a remarkable ascent, climbing more than 100% in the following 48 months. Investors who are prone to move entirely out of stocks during bear market declines might want to re-consider such action, as attempting to properly time the beginning of a new bull market can be challenging.

Investing During a Bear Market

If you have cash, considering buying opportunities during a bear market. Historically, the S&P 500 Price to Earnings Ratio (P/E) has been notably lower during bear markets. When investors are more confident, the P/E ratio typically increases, making stock valuations higher. Professional investors love bear markets because stock prices are considered to be “on sale.”

As a rule of thumb, set your investment mixture according to your risk tolerance and re-balance in order to buy low and sell high. Never cut contributions to retirement accounts during down markets. In the long run, you will benefit from buying new shares at lower prices and will achieve a lower net average purchase price.

If you’re in retirement, only the portion of your money that you won’t need for another five to 10 years should be in stocks. This process of allocating money according to when you’ll need it is called time segmentation. You want a retirement plan that allows you to relax and not have to be concerned about the daily, monthly, or even yearly market gyrations.

The above video looks at some of the tips that were given in the article published below and whether they would have been worthwhile.

WHY DOING NOTHING IS THE HARDEST BUT HISTORICALLY THE RIGHT THING TO DO

This week has so far seen a 12% fall in the value of the S&P 500 since it’s all time high just a few days ago and the most tempting thing for investors to do is to SELL SELL SELL. But why is that probably the worst course of action?

Everybody is talking about it right? Your friends have sold? You see Bloomberg or read the FT and there are panels of people predicting that the worst is yet to come – so why is selling such a disastrous strategy to adopt historically?

THE MARKET KNOWS MORE THAN YOU. Markets are highly efficient giving people the ability to trade in seconds. Algorithms scrape the internet looking for headlines and information before automatically placing a trade based upon the information they find. Investment firms have people everywhere monitoring the situation on the ground and reporting back in second by second. Everybody has access to exactly the same information at exactly the same time – that is the whole point of the fair system. Speed, quantity and quality of information is huge. Therefore, it is important to remember that every bit of news that you see, hear or read is ALREADY IN THE PRICE.

YOU HAVE TO GET LUCKY TWICE. If you want to sell out then not only do you have to select the perfect moment to sell (which was a week ago so you’ve already missed it) but you also need to know the perfect time to buy back in (which could have been at the close of yesterday’s session for all you know). This involves you making 2 decisions based on very little data and hitting that jackpot twice in a row which is highly unlikely.

THE SYSTEM WANTS YOU TO TRADE. Remember that brokers make money whether you sell at a gain, a loss or flat. All they want you to do is trade as they take a commission or a fee every time that you do it. The advertisement, the media, the general chit chat is all geared towards making you feel as though you have to do something so that everybody gets paid. The only loser is likely to be you. Do not buy in to it.

THE BEST DAY MIGHT BE TODAY AND MISSING IT COULD BE DISASTROUS IN THE MEDIUM – LONG TERM. This is the key, overarching point. Missing the best days in the market has a significant impact upon the value of your portfolio over the medium term. Indeed, if you take data from 1980-2018 then missing just the best 5 days in the market during that period would have reduced your returns by a whopping 35%!! The fact is that when everybody around you is panicking then it is your opportunity to buy – this is very hard to do but is always likely to be the best action to take. It was the infamous Warren Buffett who advised to be “Fearful when others are greedy and greedy when others are fearful”.

The below article from Fidelity gives some fantastic advice on how to navigate the downturn. It is probably what all of us already know to be true but find it hard to put into practice. And it all points towards one very obvious but tough course of action to follow – STAY CALM, DO NOTHING AND STICK TO YOUR INVESTMENT STRATEGY. If it was you plan to buy on a monthly, quarterly, bi-annual or annual basis then keep doing it. If it does not feel like the right time to do that then history tells us that it is probably the best time.

As ever, please do not hesitate to call, email or message in if you have any questions or queries or would simply like a bit of guidance.

6 Tips to Navigate Volatile Markets

When markets get choppy, it pays to have an investing plan and to stick to it.

1. Keep perspective: Downturns are normal and typically short

Past performance is no guarantee of future results.

- Market downturns may be unsettling, but history shows stocks have recovered and delivered long-term gains.

- Over the past 35 years, the stock market has fallen 14% on average from high to low each year, but still managed gains in 80% of calendar years.

2. Get a plan you can live with – through market ups and downs

Data source: Morningstar, Inc., 2019 (1929-2018)

- Your mix of stocks, bonds and short-term investments will determine your potential returns, but also the likely swings in your portfolio.

- Pick an investment mix that aligns with your goals, timeframe, and financial situation, and you can stick with despite market volatility

3. Focus on time in the market – not trying to time the market

Source: FMRCo, Asset Allocation Research Team, as of January 1, 2019.

- It can be tempting to try to sell out of stocks to avoid downturns, but it’s hard to time it right.

- If you sell and are still on the sidelines during a recovery, it can be difficult to catch up. Missing even a few of the best days in the market can significantly undermine your performance.

4. Invest consistently, even in bad times

Sources: Ibbotson, Factset, FMRCo, Asset Allocation Research Team as of January 1, 2019

- Some of the best times to buy stocks have been when things seemed the worst.

- Consistent investing can give you the discipline to buy stocks when they are at their cheapest.

- Consider setting a plan for automatic investments.

5. Get help to make the most of a down market

- While no one likes to lose money, your financial advisor may be able to help you take advantage of a down market.

- Tax rules may let you use losses on some of your investments to reduce your future tax bills, or use lower share prices to convert to a Roth IRA at a lower tax cost.

- Down markets may also be a good time to meet with your advisor to discuss adjusting your investment mix, or taking advantage of opportunities when prices are low.

6. Consider a hands-off approach

- If you are not comfortable with market risk, consider turning your portfolio over to a professional through a managed account or all-in-1 mutual fund.

- If you don’t have a strategy, or think yours may be off track, start planning now by scheduling an appointment with Adrian Cartwright today.

Any more questions? Feel free to get in touch!

We all know that dealing with financial consultants in Dubai can seem extremely daunting at first, but with the right advice and structure put in place, you can save for future.

Adrian Cartwright ACSI | Financial Consultant Dubai | Dubai Marina

WhatsApp: +971 52 855 7084

CISI Membership Number: 182193 | CII-Ref: M/505/1318

Located in Dubai, Adrian Cartwright FNCSA, represents clients throughout the United Arab Emirates, including, but not limited to the cities of Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, Fujarah, Um Al Quain, Ajman.

DISCLAIMER

The information contained in this website is for general information purposes only. The information is provided by Adrian Cartwright and while he endeavours to keep the information up to date and correct, he makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

© 2022 Adrian Cartwright – Financial Advisor Dubai

Web Design Dubai by Search Shack | Privacy Policy