The Option To Become A Millionaire

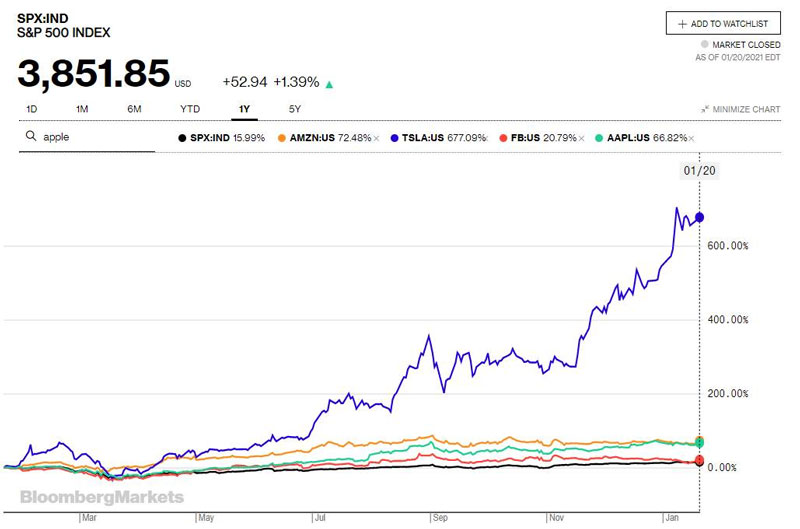

Options trading has been in the headlines more than usual of late. The stock market rally of the last 9 months or so, the GameStop saga and the news that the parents of Alex Kearns will be suing Robinhood following his tragic death have all fuelled this in the past few weeks.

But what are options and should you be buying them?

Here’s the ‘what’ in simple terms:

- Options are a way of making short term gains or losses within the market by having an opinion on the direction that an asset will move. This is what Melvin Capital was doing when it had a short position on GameStop which we looked at last week.

- They can be incredibly volatile and investors can lose or gain a lot of money in a very short space of time.

- Traditionally, they have been used by large asset management firms and hedge funds to actually reduce risk in portfolios by hedging against unexpected market movement. However, more recently they seem to be seen as a ‘get rich quick’ mechanism and are readily available through app based trading platforms.

- Please visit something like Investopedia for a full definition. This link could be useful.

Should you be buying them (‘you’ being the average retail investor)? I am going to say that it is an ‘ok’ (through gritted teeth) but only if you follow certain principles:

- Knowledge – go away and learn a lot prior to doing it. Don’t become a gambler – be an astute investor. There are a myriad of courses either on line or in person that can help you out and teach you the pitfalls.

- Be prepared to lose – this is probably not traditional investing for most people unless you are using the option to hedge against potential losses elsewhere as part of a bigger picture and wider strategy. Therefore, understand what you could lose and be prepared for that.

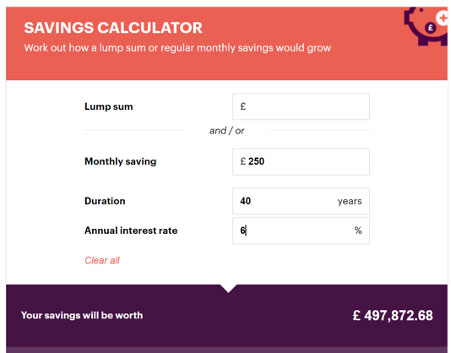

- Don’t rely on it – unless you get lucky, this is not your retirement plan. I am not saying don’t do it, but don’t bank on it.

- Somebody disagrees with you! – remember that for an option to work, somebody somewhere must think the opposite to what you think or there could be no trade. No that doesn’t necessarily mean that they are right, but it is worth bearing in mind.

The article below goes through some facts and figures of options trading and highlights some of the pitfalls – avoid them!

Retail investors flocking to one of the all-time suckers bets

Financial Times

Drawn by tales of fast money in the land of iron condors, retail traders are swarming the futures market. But do they know what they’re doing?

David Siniapkin, a postal worker in York, Pennsylvania, uses some of his retirement money to trade options. After three years and being down as much as $10,000, he’s broken even.

Siniapkin, 46, said he tries to profit from strategies such as the “iron condor,” which requires placing four different bets on the same security, risking $38 to make as much as $204 on one trade. It takes its name from the payout diagram resembling a bird with outstretched wings. Investors use options to improve returns, hedge risks or speculate on market performance.

Volume in the U.S. has tripled since 2004 to a record 3.61 billion contracts in 2009, while trading by individual investors in the same period has increased fivefold at Fidelity Investments, the world’s largest mutual-fund firm. Sophisticated online software and the growth in training offered by industry groups and brokerages, such as Charles Schwab Corp. and TD Ameritrade Holding Corp., are enabling individuals to execute advanced techniques on home computers that had once been the province of professionals. (Visit the InvestmentNews options strategies section for strategic reports and daily options picks.)

“Trading options is one of the all-time suckers’ bets,” said Whitney Tilson, founder of hedge fund T2 Partners LLC, based in New York. “Most experienced professionals lose money doing it. It’s virtually certain that inexperienced, individual retail investors will lose money doing this.”

About half of options investors earn less than $100,000 and 70 percent trade to increase income and for short-term gains, according to an April survey by the Options Industry Council, an industry education group based in Chicago. Retail traders can access professional-level analytics and trading tools that “weren’t even available to institutional investors five years ago,” said Andy Nybo, head of derivatives research at Tabb Group LLC in New York.

The numbers of trades by individuals rather than institutional investors aren’t available, said Jim Binder, a spokesman for Chicago-based Options Clearing Corp., which settles all trading of exchange-listed contracts.

Siniapkin was one of about 100 non-professionals who attended an all-day training class last month provided by online options brokerage Thinkorswim Group Inc., which Omaha, Nebraska- based TD Ameritrade acquired last year for $749 million.

Participants traveled as many as three hours to a windowless Radisson hotel ballroom near Philadelphia and scribbled notes as Bob Groves, a former Standard & Poor’s 100 Index options trader on the floor of the Chicago Board Options Exchange, waved a laser pointer at a projection screen to explain advanced trades.

“I’ll do the iron condors, I’ll do calendars, I like double diagonals,” said Siniapkin, who said he has had “mixed success” with these strategies, known as multi-leg transactions, which involve buying or selling multiple contracts on the same underlying security.

Training lets retail investors understand the risks involved, said Debra Peters, vice president of the Options Institute, the CBOE’s education division, which had a record 41,004 registrations for its free online courses last year.

E*Trade Financial Corp., based in New York, saw a 600 percent increase in attendance at training events last year, and TD Ameritrade’s education arm, Investools, has attracted more than 40,000 clients to its classes since June, about a 50 percent increase from a year earlier, the companies said.

Cost of the courses ranges from free to thousands of dollars. Thinkorswim’s session in April was free and participants were later pitched additional training and online tools, which run from $299 to more than $2,000.

“I’m not a fan of people who say you shouldn’t be doing this,” said Thinkorswim’s founder Tom Sosnoff of investors using complex strategies. “Imagine you walked into the casino and people said to you, ‘You look stupid so you can only play the slots.’”

Options are contracts that grant their buyers the right, without the obligation, to buy or sell a security, a commodity or an index’s cash value at a set price by a specific date. Call options give the right to call a security away from another owner if the security reaches its strike price on or before the contract’s expiration date. Put options give the right to sell.

Like gambling on the Super Bowl and having to beat the point spread, options traders may lose if they predict the correct direction of a stock move and not the magnitude. For example, an investor who buys a put to sell a biotechnology stock before a Food and Drug Administration decision may get the direction of the stock’s move right while losing money if the security doesn’t fall or rise far enough.

“Options trading is always going to be more complicated than equities trading but it doesn’t have to be more risky,” said Randy Frederick, director of trading and derivatives at Schwab, the largest independent brokerage by client assets. “They can potentially reduce the amount of losses in a bearish market.”

Simpler strategies include buying put spreads to protect stocks from declines and selling call options to profit from the sale while betting that the stock won’t rise past a given level.

“My first couple of trades I did very, very well and I got a little big headed and very, very greedy, and I ended up blowing out an account,” said John Mahoney, 49, an engineer who trades options weekly. “I lost about $20,000 initially.”

Mahoney said he made $4,000 one week in April by playing multiple contracts and is working his way back into the market by trading smaller amounts and attending classes.

Regulators permit trading options using retirement accounts, said Herb Perone, spokesman for the Financial Industry Regulatory Authority. Certain trading may violate Internal Revenue Service rules, which is why firms including Schwab, Fidelity, TD Ameritrade, E*Trade, Interactive Brokers Group Inc. and OptionsXpress Holdings Inc. prevent investors from executing strategies that may cause an IRA to go into debt, according to the companies.

About 46 million U.S. households owned IRAs last year, according to the Investment Company Institute, a Washington- based mutual fund trade group. Accounts held for 20 years or more had a median of $75,000 in assets, according to ICI.

Michael Madden, a 48-year-old sales manager from Whitehall, Pennsylvania, said he transferred some of his IRA money to Thinkorswim to trade options. He said he lost about 40 percent when he started three years ago and has since recovered those losses, purchasing about $5,000 to $10,000 in contracts a week.

Fidelity has started allowing spread trades in IRAs, an options strategy requiring two transactions usually executed at the same time, said Gregg Murphy, who oversees equities and options trading for the Boston-based company’s retail customers. Schwab, based in San Francisco, is testing spread trading for retirement accounts with a few hundred customers and hopes to expand it later this year, said Frederick.

Options shouldn’t be an integral part of investors’ long- term planning, of which retirement money is the “nucleus,” said Jonathan Krasney, president of Krasney Financial LLC, a Mendham, New Jersey, fee-based wealth management firm.

“My concern is that investors can quickly dig themselves into a deep hole if they venture into the options market,” Krasney said. Most trading involves contracts that expire within months, so investors can’t hold them indefinitely to recoup losses or wait for gains, as they can with stocks, Krasney said.

Brokers must approve investors to trade options, said Gary Goldsholle, vice president in Finra’s general counsel office. Customers must provide companies with details about their financial status and trading experience, and sign a document saying they received a copy of the Characteristics and Risks of Standardized Options from the Options Clearing Corp.

Karen Fitchett, 64, said the learning curve has been steep. The New York real estate investor said she has lost tens of thousands of dollars trading options since starting in 2007, which is why she still attends classes like the one provided by Thinkorswim.

“It’s become like an intellectual affair,” she said. “I just became seduced.”